Customer data protection is important to every business that wants to protect its financial security and its reputation — whether you’re a managed service provider (MSP) or an internal IT team member.

When talking to your clients, you’ll probably tell them that a huge reason why protecting customer data is mission critical is because their entire business depends on it. If they’re vulnerable to hacking or data loss, they’re setting themselves up for fines, hits to their reputation, lawsuits, and a strong chance of losing their business altogether.

You might even tell them about a case study like Equifax, whose infamous data breach cost them $4 billion in market value. The FTC also fined Equifax $700 million and is still dealing with remediation and negative press from the event.

IT professionals tell stories like these all the time, but many forget how important customer data protection is to their own businesses and allow it to become an afterthought. In this article, we’ll discuss the nature of customer data protection, why it matters to everyone, and share some expert guidance on how to protect customer data.

What this article will cover:

- What is customer data protection?

- Why should customer data be protected?

- The four types of customer data

- Customer protection responsibilities

- How to protect customer data

- Customer data protection best practices

- FAQs

NinjaOne’s all-in-one IT management platform helps you protect, monitor, and secure customer data with ease.

What is customer data protection?

Customer Data Protection is a concept that revolves around the security and privacy tools and methods used to safeguard information collected from clients. This includes any collected marketing data, financial data, and information about their behaviors — all which can be very valuable to hackers.

For MSPs and IT administrators, customer data can also include login credentials and IT management information. Protecting this is essential, as an organization’s client data can serve as “the keys to the castle” for hackers who want to infiltrate their clients’ networks.

Why is customer data protection important?

When discussing customer data protection, we usually refer to something important to data privacy called Personally Identifiable Information (PII). This refers to any information that can directly identify an individual, such as names and addresses, email addresses, financial data, copies of state-issued IDs, credit card numbers, or IP addresses.

Because PII is so sensitive and protecting it is vital to every individual, a comprehensive data protection strategy becomes essential. Here are key reasons why every organization needs to develop a comprehensive client data protection plan, regardless of their size:

Compliance with laws and regulations

Data protection regulations differ considerably from country to country, but it’s important to remember that they apply to the location of the citizen, not the entity collecting or processing the data. It’s likely that any business with an online presence will have to adhere to legislation such as GDPR (in the case of EU citizens) or CCPA (for Californian citizens). Many of these regulations are quite strict and failure to comply with them will result in hefty fines.

Customer trust and brand reputation

Consumers view a data breach as a breach of trust. Like it or not, people who hand over their personal information to a business expect that it will be protected — and collectively they are not quick to forgive mistakes. Some major brands that have had lapses in customer data protection have suffered immensely from the PR fallout, with some even facing class-action lawsuits from their customers.

Time and productivity loss

Ignoring the need for customer data protection can have a major impact on business processes later on. Aside from the financial, legal, and reputational consequences of a potential mistake, many hours and resources can end up being spent investigating incidents and then fixing them. If this causes assets to be shifted away from other operations, it can mean serious downtime throughout the organization.

Four types of client data

1) Master data

Master data involves key information shared across the enterprise to facilitate high-level business processes. Master Data Management is the practice of responsibly managing and processing master data according to the organization’s needs.

Consider master data the functional data for businesses. It includes things like master lists of customers, products, and vendors — organizations should think of the client data in their CRM and RMM. This type of data is often considered mission-critical for the business, and often needs to be shared and accessible across the company, while also remaining secure.

Master data is specifically created, managed, and stored in such a way that it can be accessed for necessary business processes or functions. An example would be a CRM database that is integrated with other applications so that client and prospect lists can be viewed and used by the marketing department, sales team, and — through an RMM integration — the techs on the team.

2) Transactional data

Transactional Data is typically created, stored, and utilized in operational and/or transactional contexts including banking or invoicing transactions. Safe processing and storage requirements for transactional data vary amongst industries. For an e-commerce company that sells a product online, this usually includes data regarding customer shopping and purchasing behaviors, as well as actual payments and fulfillment data. Customers’ PCI (Personal Credit Information) data remains private and compliant. Vendor banking/payment information should be protected as well.

Transactional data tends to run on a much larger scale than other types of data due to volume balanced against its potential value to a hacker. Ensuring the privacy and security of this data and the associated Personal Credit Information is of key importance when managing the policies and processes surrounding it.

3) Reference data

Reference Data is stable information that categorizes data, correlates it with consistent values, and follows relatively fixed internal and/or external standards.

By nature, reference data tends to stay the same or change very slowly over time. Examples include parts and product lists, breakdowns of customer segments, vendor contact lists, and internal process documentation.

4) Freeform data

Freeform Data, also known as unstructured data, is not organized or formatted in a predefined manner. Any data that is not stored in a spreadsheet, table, or database that is easily referenced by a computer is considered freeform.

Think about a simple contact form on a website. Fields like “Name” and “Email” can be understood by computer automation and instantly used by other applications, whereas entries into “Comments” will be considered freeform.

Freeform data can also include documents, blog posts, journal articles, emails, surveys, reviews and feedback, social media posts, and phone scripts. Because freeform data is as open-ended as human creativity, it is the most difficult to process and analyze.

Who is responsible for protecting client data?

While we know MSPs and IT teams have a responsibility to protect their customer data – what about the customers themselves? What is their level of responsibility in protecting their own data?

A litany of past surveys show that consumers believe their responsibility to secure their data is minimal. Instead, they believe that the responsibility for keeping their PII safe falls almost entirely on the companies they share data with.

Consumers are more concerned with convenience, so they tend to leave concerns about security up to the businesses offering the services. And as we discussed before, they can be pretty adamant about their stance. The majority of consumers say they would stop using a retailer (60%), bank (58%) or social media site (56%) if it suffered a breach. 66% of consumers say they would be unlikely to do business with an organization that experienced a breach where their financial and sensitive information was stolen. (Source: Gemalto)

In effect, these responses mean that consumers are willing to take risks when it comes to their security and privacy, but are quick to blame the business if something goes amiss.

The greater problem here is that pointing fingers does nothing to confront the real challenges of privacy and security. While government regulations and data breach disclosure laws hold companies responsible for protecting data, consumers need to take advantage of current ways to protect themselves.

Even small steps can help the consumer take control of their own security. Enabling two-factor authentication, avoiding temptation when sharing life details on social media, and using strong passwords are all simple steps — but consumers must be willing to take the hit to convenience to leverage them.

Customer data protection best practices

1. Implement strong authentication and access controls

A simple yet efficient way to enforce customer data protection is through robust access controls that allow an organization to control who can manage client data protection and modification. Implementing strategies such as multi-factor authentication (MFA) as a standard security measure can reduce risks and support customer data protection policy.

Several tools are available in the market for organizations to choose from when implementing MFA strategies. These include authenticator apps or messaging-based MFA platforms. Additionally, organizations should follow the principle of least privilege (PoLP), ensuring employees only have access to the data they need for their role.

2. Data masking and anonymization

Data masking and anonymization strategies are other ways to reduce the risk of exposing client information. This is done by replacing or scrambling Personally Identifiable Information (PII), preventing unauthorized access while maintaining the data’s usability. Here are some strategies for data masking and anonymization:

- Tokenization. This strategy involves replacing sensitive data elements with non-sensitive equivalents (e.g., substituting social security numbers with unique tokens).

- Pseudonymization. This mechanism refers to the process of identifying information with artificial identifiers to limit exposure in case of a data leak or compromise.

- Generalization. This procedure involves reducing data granularity (e.g., storing an age range instead of an exact birthdate).

IT administrators and MSPs can utilize these practices for testing and analytics environments, ensuring real customer data are hidden and never exposed.

3. Secure data transfers and storage

Data in transit and at rest risk being exposed to destructive vulnerabilities. This should prompt organizations to enforce a customer data protection policy with robust encryption. Here are some security strategies for data transfer and storage:

- Encrypting stored data. Usage of AES-256 encryption for databases and cloud storage.

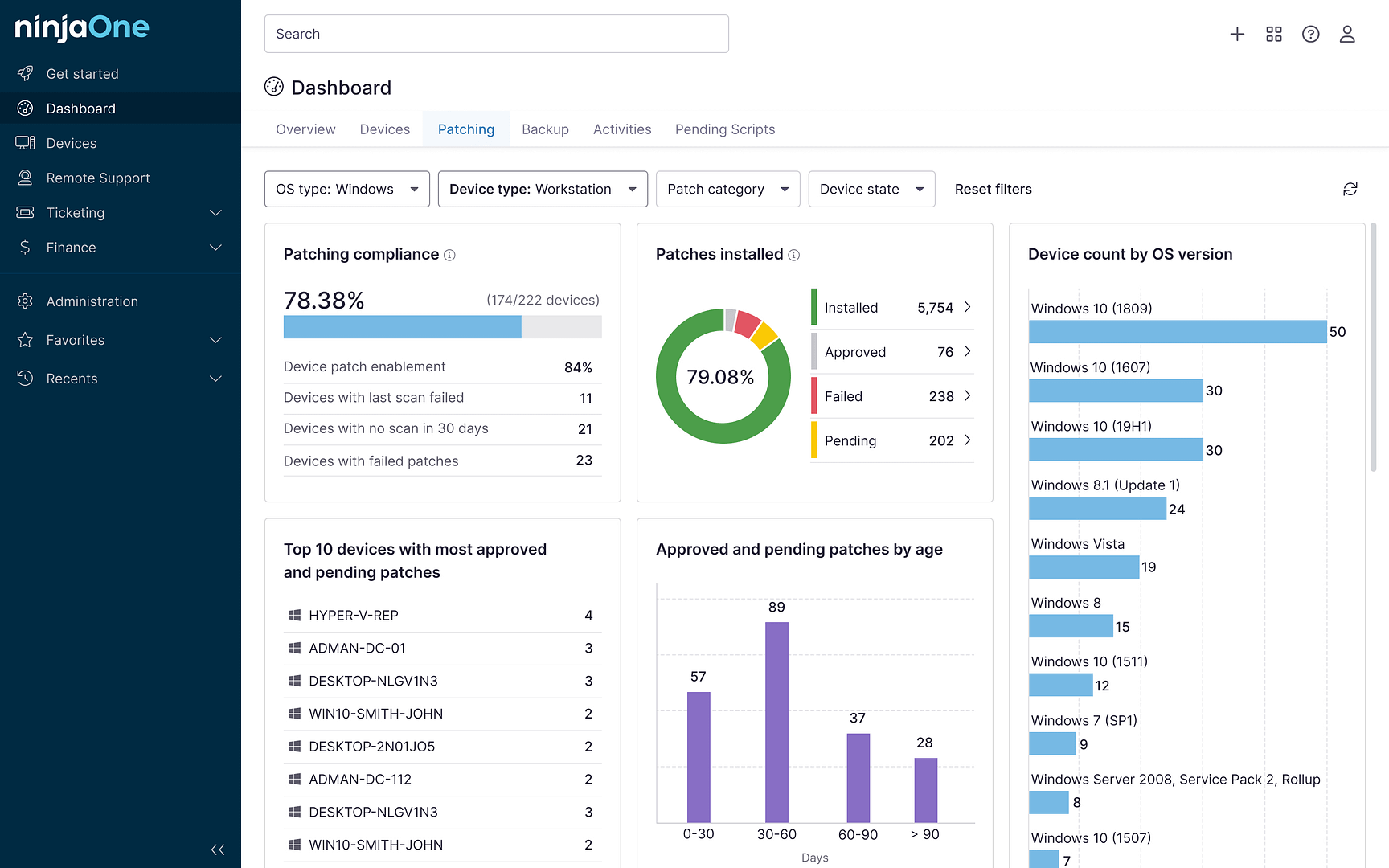

- Implementing endpoint security. Ensuring that all devices accessing customer data have up-to-date security software with the use of an effective endpoint management solution.

- Using secure file-sharing protocols. Avoidance of email attachment usage for sensitive data while implementing secure file-sharing platforms with strict access controls.

4. Continuous monitoring and threat detection

Client data protection is enhanced when organizations actively monitor their systems for potential security threats. This includes:

- Setting up real-time monitoring tools. Organizations can employ a strong IT solution to monitor their systems continuously. Monitoring tools can help detect unauthorized access or anomalies in data usage.

- Logging access to sensitive data. Having a system that constantly logs activities related to managed data can help track who is viewing or modifying customer information.

- Utilizing threat detection solutions. There are a plethora of platforms organizations can use to employ a system that can identify suspicious behavior patterns before they escalate into breaches.

5. Regular security audits and compliance checks

Aside from monitoring and threat detection, a regular security audit can ensure that the customer data protection policy in place is implemented effectively. Regular security assessments can help identify vulnerabilities before they cause disruptions and irreversible troubles. Organizations should:

- Conduct penetration testing to simulate cyberattacks and uncover weaknesses.

- Perform internal risk assessments to evaluate how customer data is stored and processed.

- Depending on your industry and customer base, you must ensure compliance with GDPR, CCPA, HIPAA, and PCI-DSS regulations.

6. Employee training and security awareness

Human errors in cybersecurity are inevitable but preventable. While this factor can be a big catalyst in data security, human errors can be avoided through effective staff education of security awareness practices. Some practices organizations can implement are:

- Regular security training. Conducting scheduled training that tackles customer data protection policy and general infosec best practices is one way to educate employees on phishing attacks, social engineering tactics, and secure data handling practices.

- Run phishing simulations. Demonstrations can also help imitate real-life scenarios that involve testing employees’ ability skills to identify and report suspicious activities such as email phishing.

- Enforce strong password policies. Emphasize the importance of using strong passwords across your organization. This should help encourage staff to not only create strong passwords but also utilize reliable password management solutions.

📖Read more about the 12 Most Common Cyberattacks to protect your valuable customer data.

7. Create an Incident response and breach notification plan

The risk of data breaches is never zero, even with the best security measures and client data protection policies. An incident response plan can help mitigate critical instances by ensuring organizations can react quickly while minimizing damages. Here are some steps for planning for an incident response and breach notification.

- Establishment of an incident response team. Delegate staff that will be responsible for investigating and managing security incidents. These people should preferably have experience implementing contingency plans during a data breach.

- Standardization of escalation procedures. A structured escalation process is necessary for reporting breaches internally and externally. This streamlines the procedure so everything is handled efficiently and consistently, ensuring timely communication with stakeholders and adherence to legal and regulatory requirements.

- Following breach notification laws. Steps that involve reporting to authorities should also be enforced such as GDPR’s requirement to notify law enforcement within 72 hours of a data breach.

Customer data protection best practices

While having a standard customer data protection policy is essential, several factors may still get in the way and put this critical information at risk. To prevent threats from weakening client data protection policies, here are some best practices you can follow:

-

Stay up-to-date on encryption

Encryption technologies are constantly evolving to meet changes in the threat landscape. Organizations that aren’t reviewing and updating their encryption practices are often left vulnerable to cyberattacks. Work with your IT security team to establish a regular audit schedule to see if your encryption technology and practices are as current as possible.

-

Limit access to customer information

Least privilege access is not just a concept for admin and user roles. Not everyone in your organization needs access to customers’ personal information. By limiting access to those with a genuine need, you reduce opportunities for hackers to find and exploit a weakness. This also reduces the threat of human error or deliberate theft of customer information by insiders.

-

Use password management tools

Passwords are still a key component of security, even though they often seem trivial compared to the tools available. One of those tools that brings strong passwords back into the forefront is a password management application. They create and store complex passwords for all of the accounts your clients access, encrypting and storing each password so that end users need only remember one master password. Because credentials have become such a weak point for cyberattacks, password management should be a mandatory addition to every MSP and IT administrator security stack.

-

Collect only necessary data

It can be tempting to collect as much data as possible “just in case”, but doing so can quickly lead to problems. Collecting unnecessary customer data means not only wasted energy and resources, but also makes your data more rich and enticing for hackers. Collect only what you need for defined business purposes. To put consumers and end users at ease, you can also offer them the option of opting out of sharing personal information.

-

Consider destroying data after you’ve used it

Stored data is a potential risk. While some customer data needs to be stored in perpetuity, that’s not the case for all data. Consider destroying customer data after you’ve made best of use it rather than holding it and bearing the additional security burden.

-

Make customer privacy everyone’s business

A comprehensive security program and privacy policy should be created and adopted by everyone in your organization. Every stakeholder needs to understand the importance of customer data protection and, more importantly, adhere to your policies. The same tactic should be applied to towards your end users and their involvement in the overall security process.

-

Let customers know their information is safe

Privacy is a true concern for the public, so letting customers know exactly what you’re doing to keep their PII safe is beneficial to everyone. Be straight and to the point with your disclosure of security practices. Hiding the details of your customer data protection methods in a privacy statement that no one actually reads won’t cut it. Openly sharing your commitment to privacy is a far better option and can ultimately help your company’s reputation and build trust.

NinjaOne’s automated patching, secure access controls, and cloud backups can help organizations stay compliant and safeguard sensitive information.

FAQs

1. What is the difference between data privacy and data security?

While these terms are rarely used interchangeably, understanding their differences can help clients and new IT administrators differentiate between protecting customer data and protecting individuals’ rights and control they have over their data. Data security refers to the course of actions that help organizations combat cyber security threats that may impact data security. Meanwhile, data privacy focuses on how personal information is collected, stored, and shared, ensuring individuals have control over their data.

2. How do companies protect customer data when they have limited resources?

Companies such as small businesses may have limited resources to spend compared to enterprises. However, that should not hinder them from prioritizing customer data protection. They can leverage cost-effective security measures, such as MFA and strong password creation, through a password management platform. There are also cloud-based security solutions with built-in compliance management features that can help maintain security infrastructures. Regular employee training can ensure staff is up-to-date on customer data protection policy strategies. Most of these strategies are either free or would only cost them minimally.

3. What should a business do immediately after a data breach?

As established in this guide, creating a team of front liners to mitigate data breach instances should be a top priority. This team should be able to contain the breach by determining and isolating affected systems, revoking unauthorized access, and confining compromised data. Next, an impact assessment should be in place to determine what customer information was compromised and whether regulatory authorities need to be notified. Most of the time, transparency towards affected clients is necessary. They should be informed about the incident and instructed on the next action. Finally, an internal review should be conducted to identify weaknesses, patch vulnerabilities, and strengthen security measures to prevent future incidents.

4. What are the challenges in customer data protection?

Several factors may affect the implementation of customer data protection practices. One of those is the ever-evolving data breach strategies that have become more sophisticated over the years. Another one is maintaining the balance of security and client convenience since the more robust security measures are, the easier customers may get frustrated when following them. Complying with data protection regulations may also become a challenge when complexities due to regional differences are involved. Lastly, as we mentioned above, human errors are inevitable, which could increase the risk of data breaches and compromise customer information.

Conclusion

Data is the new currency of cybercrime, and ignoring customer data security is no longer an option for organizations of any size. Hackers have become lethally efficient in deceiving companies through social engineering and other attacks, and no business wants to go through the stress of reaching out to customers to disclose a data breach. Customer data can destroy trust and lead to years of costly legal, regulatory, and reputational consequences.

The best approach to protecting customer data is an active approach to cybersecurity. Employing a unified endpoint management solution like NinjaOne can help protect, monitor, and secure customer data with its patch management automation, cloud backup capabilities, integrations with security services, and more. Leveraging a robust endpoint management platform alongside following the security best practices outlined in this guide should get you started and help you on your own journey to protect your customers’ data.