What is a compliance audit?

A compliance audit systematically examines an organization’s adherence to established rules, regulations, and standards governing its industry or sector. This rigorous process is designed to evaluate whether the company’s operations, policies, and procedures align with legal requirements, industry standards, and internal protocols. Essentially, a compliance audit acts as a comprehensive health check, ensuring that the organization operates within the bounds of the law and ethical guidelines.

Compliance audits play a crucial role in upholding the integrity of organizations by serving as a proactive measure to identify and rectify deviations from established norms. By scrutinizing business practices and operational frameworks, these audits safeguard against accidental or intentional violations, fostering an environment where adherence to rules and regulations is not just a legal obligation but a core component of corporate ethos.

Ensure compliance with industry regulations and internal policies with NinjaOne’s real-time visibility of your IT environment.

Compliance audits are typically conducted by internal audit teams or external auditing firms with specialized knowledge in regulatory compliance. The independence of these auditors ensures an impartial evaluation. The essential nature of compliance audits lies in their ability to provide stakeholders, including investors, regulators, and the public, with assurance that the organization is committed to ethical conduct, legal compliance, and sustained business integrity. In an era of increasing scrutiny and evolving regulations, these audits serve as indispensable tools for organizations to navigate the complex terrain of governance and compliance successfully.

Audit vs compliance: what’s the difference?

Compliance typically refers to adhering to industry regulations or internal policies applicable to an organization. Compliance means an ongoing effort to adhere to set standards before any evaluation occurs. Audits, on the other hand, are assessments conducted to ensure compliance has been achieved.

What is a compliance audit report?

Think of compliance as the goal and regular audits as the checkpoints ensuring you’ve reached—and maintained—that goal.

A compliance audit report serves as the official documentation of the findings from a compliance audit. These reports provide an overview of an organization’s adherence to specific regulations or standards. They typically include finding and highlighting gaps, such as non-compliance issues and security vulnerabilities. Compliance audit reports also provide actionable steps for addressing areas of concern or improving compliance management.

Key objectives and goals of compliance audits

The primary objectives of a compliance audit extend beyond a mere review of processes. They include assessing the effectiveness of internal controls, identifying potential areas of risk or non-compliance, and recommending corrective actions to fortify the organization against regulatory pitfalls. Compliance audits aim to foster a culture of integrity within the company, promoting ethical behavior and mitigating the likelihood of legal and reputational repercussions.

Importance of compliance auditing

Compliance auditing is important in the contemporary business landscape as a critical mechanism for organizations to uphold integrity, navigate complex regulatory frameworks, and mitigate risk exposure. By fostering a culture of ethical conduct and proactive risk management, compliance auditing protects against legal repercussions, financial penalties, and reputational damage.

The significance of compliance audits in various industries

Compliance audits hold immense significance across diverse industries, serving as a linchpin for organizations seeking to thrive in a highly regulated environment. Adherence to industry-specific regulations is paramount, from finance to healthcare, manufacturing to technology. Compliance audits provide a standardized framework for businesses to assess and address their compliance status, ensuring they remain in step with the unique regulatory landscapes governing their operations.

Ensuring legal and regulatory compliance

The assurance of legal and regulatory adherence is at the core of the importance of compliance review and auditing. Organizations are subject to a myriad of laws and standards that evolve over time. Compliance audits act as a proactive measure, systematically reviewing internal processes to identify and rectify any deviations from these regulations. This safeguards the organization against legal repercussions and fosters a culture of responsible governance.

Mitigating risks and avoiding penalties

Compliance audits serve as powerful risk mitigation tools, enabling organizations to identify and address potential risks before they escalate. By conducting thorough assessments of processes and operations, audits help pinpoint vulnerabilities and implement corrective measures. This proactive approach not only minimizes the likelihood of regulatory breaches but also aids in avoiding penalties, fines, and reputational damage that may arise from non-compliance.

Enhancing operational efficiency and reputation management

Beyond mere regulatory adherence, compliance audits contribute to the overall efficiency of organizational processes. These audits enhance operational efficiency by streamlining operations, identifying inefficiencies, and promoting best practices. Moreover, in an era where reputation is a valuable currency, compliance audits play a pivotal role in maintaining and bolstering an organization’s reputation. Demonstrating a commitment to compliance and ethical business practices instills confidence in stakeholders and positions the organization as a responsible and trustworthy entity in the eyes of the public.

In conclusion, the importance of compliance auditing extends far beyond a mere checkbox exercise. It is an integral part of corporate governance, risk management, and strategic planning.

IT compliance audit examples

Compliance auditors ensure that organizations follow applicable industry standards. Here are some of the most common compliance audit examples for IT departments:

1. HIPAA

The Health Insurance Portability and Accountability Act of 1996 (HIPAA) protects patients’ from having personal information. Organizations in the healthcare industry that store patient information must undergo a HIPAA audit. This regulatory audit evaluates how patient records are stored, accessed, and transmitted.

2. PCI DSS

In 2004, Visa, Mastercard, Discover, JCB and American Express established the Payment Card Industry Data Security Standard (PCI DSS). Retail businesses, finance service providers, and e-commerce websites must pass a regulatory audit with PCI DSS. This standard ensures that payments made with credit and debit cards meet data encryption requirements and any customer information given during payments. PCI DSS helps protect financial and personal data from data breaches and prevents fraud.

3. GDPR

The General Data Protection Regulation (GDPR) is a data privacy law that applies to countries within the EU. GDPR compliance is required for any organization operating in EU countries or non-EU organizations that handle EU customer data. This IT audit and compliance focuses on explicitly asking for consent when processing user data and securely storing that data.

4. ISO 27001

An ISO compliance audit evaluates an organization’s compliance with ISO standards, such as ISO 27001 for information security. An ISO compliance auditor would verify whether or not an organization is proactively identifying vulnerabilities, protecting sensitive data, and developing response plans for any issues.

5. SOC 2

A Systems and Organizational Controls (SOC) is an IT audit and compliance guideline that ensures that businesses providing cloud or SaaS solutions are safeguarding customer data. SOC 2 follows standards set by the Trust Service Criteria (TSC) and includes five criteria:

- Security

- Availability

- Confidentiality

- Privacy

- Processing Integrity

Organizations with SOC 2 certification ensure that clients’ and stakeholders’ data is properly handled. A SOC 2 compliance audit report typically takes three months to a year to complete.

Internal vs. external compliance audits

Internal and external compliance audits represent distinct approaches to assessing an organization’s adherence to regulations.

Internal compliance audits

Conducted by an organization’s internal audit team, internal audits involve an in-depth examination of processes, policies, and controls. Internal auditors possess insider knowledge, allowing them to assess the organization’s compliance from an intimate perspective. These audits often focus on operational efficiency, risk management, and adherence to internal policies.

External compliance audits

External compliance audits are conducted by independent third-party auditing firms or regulatory bodies. External compliance auditors bring an objective and unbiased perspective, offering an impartial assessment of the organization’s compliance status. These audits typically focus on adherence to external regulations, industry standards, and legal requirements.

Which approach is better?

The choice between internal and external compliance audits depends on an organization’s specific needs and circumstances. Neither is inherently “better” than the other; they serve different purposes and can complement each other when used strategically. Here are some considerations:

Internal compliance audits

Pros:

- In-depth knowledge: Internal auditors have a deep understanding of the organization’s processes, culture, and operations.

- Cost-effectiveness: Internal audits can be more cost effective as they utilize existing resources within the organization.

- Ongoing monitoring: Internal audits can provide continuous monitoring and improvement of internal processes.

Cons:

- Lack of objectivity: Internal auditors may face challenges in maintaining complete objectivity due to their familiarity with the organization.

- Limited specialized expertise: Internal teams may lack specific expertise in certain regulatory areas.

External compliance audits

Pros:

- Objectivity: External auditors bring an unbiased, independent perspective to the assessment.

- Specialized expertise: External auditors often have specialized knowledge in various regulatory requirements and industry standards.

- Assurance of independence: External audits can assure stakeholders, regulators, and the public of the impartiality of the audit process.

Cons:

- Higher costs: External audits can be more expensive due to the need to hire independent auditing firms.

- Potential disruption: External audits may disrupt normal operations during the assessment period.

Choosing internal or external compliance audits

Internal audits

Consider internal audits for routine checks, ongoing monitoring, and when a deep understanding of internal processes is crucial. They are particularly effective for maintaining a proactive compliance culture within the organization.

External audits

Opt for external audits when comprehensive assessments are needed, especially for regulatory compliance assurance. External audits are often mandated by regulatory bodies or required for publicly traded companies to validate compliance efforts independently.

In many cases, a combination of both internal and external regulatory audits can offer a well-rounded approach to compliance management. Internal audits can serve as a proactive, day-to-day tool, while periodic external audits provide an independent validation and assurance to stakeholders.

Types of compliance audits

Compliance audits come in various forms, each tailored to assess adherence to specific regulations and standards within distinct realms of an organization’s operations.

Financial compliance audit

A financial compliance audit scrutinizes an organization’s financial statements, transactions, and accounting practices to ensure accuracy, transparency, and compliance with accounting standards and regulations. It aims to detect and rectify any financial irregularities or misstatements.

Financial compliance audits focus on financial controls, reporting accuracy, and adherence to accounting regulations. They are crucial for maintaining the integrity of financial information and instilling confidence among stakeholders.

Examples:

- Sarbanes-Oxley Act (SOX) Compliance Audit

- Generally Accepted Accounting Principles (GAAP) Compliance Audit

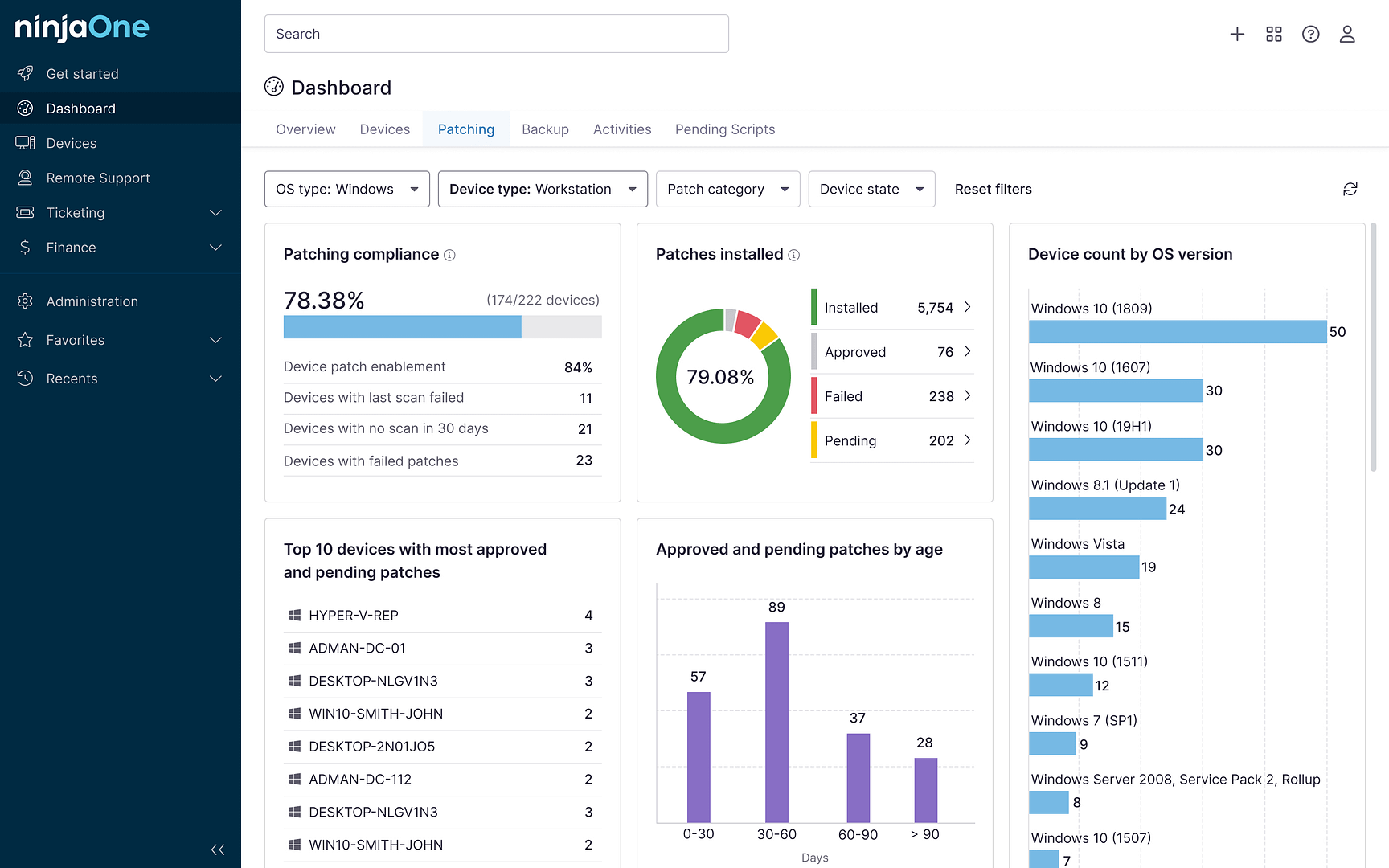

IT compliance audit

IT compliance audits assess an organization’s information technology systems, processes, and controls to ensure they meet regulatory requirements, industry standards, and best practices. These audits address data security, privacy, and the integrity of IT infrastructure.

IT compliance audits focus on cybersecurity, data protection, access controls, and overall IT governance. They are vital for organizations handling sensitive information to mitigate cyber threats and ensure data integrity.

Examples:

- Payment Card Industry Data Security Standard (PCI DSS) Compliance Audit

- Health Insurance Portability and Accountability Act (HIPAA) IT Compliance Audit

- System and Organization Controls (SOC & SOC 2) Security Audit

Environmental compliance audit

Environmental compliance audits evaluate an organization’s adherence to environmental regulations and sustainability practices. These audits assess the impact of operations on the environment, waste management, and compliance with environmental laws.

Environmental compliance audits concentrate on eco-friendly practices, waste disposal, emissions, and adherence to environmental laws. They are essential for organizations aiming to minimize their ecological footprint and meet sustainability goals.

Examples:

- Clean Air Act compliance audit

- Waste Management compliance audit

Healthcare compliance audit

Healthcare compliance audits focus on ensuring adherence to healthcare regulations, patient privacy laws, and industry standards. These audits assess the quality of patient care, medical record-keeping, and compliance with healthcare laws.

Healthcare compliance audits emphasize patient confidentiality, data security, billing accuracy, and overall compliance with healthcare laws. They are critical for healthcare providers to maintain the trust of patients and regulatory bodies.

Examples:

- Health Insurance Portability and Accountability Act (HIPAA) compliance audit

- Medicare/Medicaid compliance audit

The compliance audit process

-

Planning and scoping

The first step in a compliance audit is meticulous planning and scoping. This involves defining the audit’s objectives, identifying the regulatory requirements applicable to the organization, and outlining the scope of the audit. During this phase, auditors collaborate with key stakeholders to establish a clear understanding of the processes, policies, and controls that will be scrutinized.

-

Data collection and analysis

Once the audit scope is defined, auditors proceed to gather relevant data and documentation. This involves interviews, document reviews, and examination of internal controls. Data analysis is a critical component where auditors assess the effectiveness of existing controls, identify deviations from compliance standards, and analyze trends or patterns that may indicate areas of concern.

-

Evaluation and reporting

The evaluation phase involves assessing the collected evidence against established compliance criteria. Auditors determine whether the organization’s practices align with applicable laws, regulations, and internal policies. Findings are then documented in a comprehensive report, which includes a summary of compliance status, identified deficiencies, and recommendations for improvement. This report is typically shared with management and relevant stakeholders.

Benefits of IT audits and compliance

-

Strengthening your security posture

Audits identify vulnerabilities and gaps in your IT systems, helping you fortify them against data breaches, ransomware, and other cyber threats.

-

Regulatory compliance

Staying audit-ready ensures you meet all legal requirements, avoiding fines and legal consequences.

-

Operational efficiency

Preparing for an internal audit and compliance often involves streamlining IT workflows, and ensuring your team works efficiently while maintaining compliance.

-

Continuous improvement

IT audits and compliance offer valuable insights that help organizations streamline their processes, align with best practices, and remain up-to-date with evolving regulations.

The role of compliance audit reports in decision-making and improvement

Compliance audit reports are pivotal in guiding decision-making and fostering continuous organizational improvement. The key functions include:

- Identifying gaps and deficiencies: Audit reports provide a clear picture of areas where the organization falls short of compliance standards. This information is crucial for pinpointing weaknesses in processes and controls.

- Informing decision-making: Management relies on audit reports to make informed decisions regarding corrective actions, process enhancements, and strategic initiatives. The findings help prioritize efforts to address the most critical compliance issues.

- Facilitating accountability: Audit reports establish accountability by clearly outlining responsibilities for addressing identified deficiencies. This ensures that corrective actions are assigned to the appropriate individuals or departments.

- Driving continuous improvement: Compliance audit reports serve as valuable tools for fostering a culture of continuous improvement. By highlighting areas for enhancement, organizations can implement changes that not only address immediate compliance concerns but also contribute to long-term operational excellence.

Achieving success IT audits and compliance

We’ve taken a deep dive into compliance audits, gaining a nuanced understanding of their fundamental concepts and diverse applications across industries. Emphasizing these audits’ pivotal role in upholding organizational integrity, we’ve learned about the varying types of compliance audits, showcasing their contributions to risk management and governance in every realm, from IT to finance.

Keep your organization compliant with industry regulations and internal security standards with NinjaOne’s in-depth guide.

Through exploring the compliance audit process, we’ve seen that these assessments are not simple procedural exercises but strategic tools for informed decision-making and continuous improvement.

We encourage businesses to prioritize compliance and robust audit practices, recognizing them not only as regulatory necessities but as essential components for building and sustaining a reputation of trust and credibility in a dynamic and demanding business landscape.