Compliance management refers to the overall strategy organizations follow to adhere to various laws and regulations or how they intend to observe ethical standards. For industries that constantly manage and handle personally identifiable information (PII), such as healthcare, legal, and finance, compliance management is crucial. That said, all enterprises must have some level of compliance management in their overall cybersecurity strategy.

It’s worth noting that compliance management is a dynamic and systematic process that needs to be evaluated periodically—or as standardized in your specific industry. This may be easier said than done, considering that 85% of business leaders feel that compliance requirements have become more complex in the last three years, and 41% state that they need additional support for new business models (PwC’s Global Compliance Study 2025).

This guide explores the definition, importance, challenges, best practices, and future trends in compliance management.

What is compliance management?

When searching for “What is compliance management?” you may encounter several definitions. However, stated simply, compliance management is the process by which businesses ensure adherence to various regulations, laws, and standards that apply to their operations. It involves monitoring, analyzing, and assessing all ongoing processes (and technologies) within an organization to maintain regulatory integrity and business efficiency.

The primary goal of compliance management is to ensure that the company’s activities are conducted within the boundaries of applicable laws and regulations. Examples of this include educsting all employees on workplace safety policies, maintaining a strict anti-discrimination policy, and abiding by environmental standards. SOC compliance is a specific example of a compliance framework that helps businesses know what actions need to be taken to increase data security.

This process also helps businesses become aware of changes in related legal requirements and industry standards so organizations can remain committed to appropriate compliance regulations.

Types of compliance

- Regulatory compliance: This is how an organization complies with external laws like GDPR, HIPAA, and SOX.

- Corporate compliance: This refers to internal policies governing workplace conduct, ethics, and operations.

- Data compliance: This ensures that businesses meet strict data privacy laws to protect sensitive information. Some examples include PCI DSS and CCPA.

- IT compliance: This is how organizations keep their data and sensitive information secure.

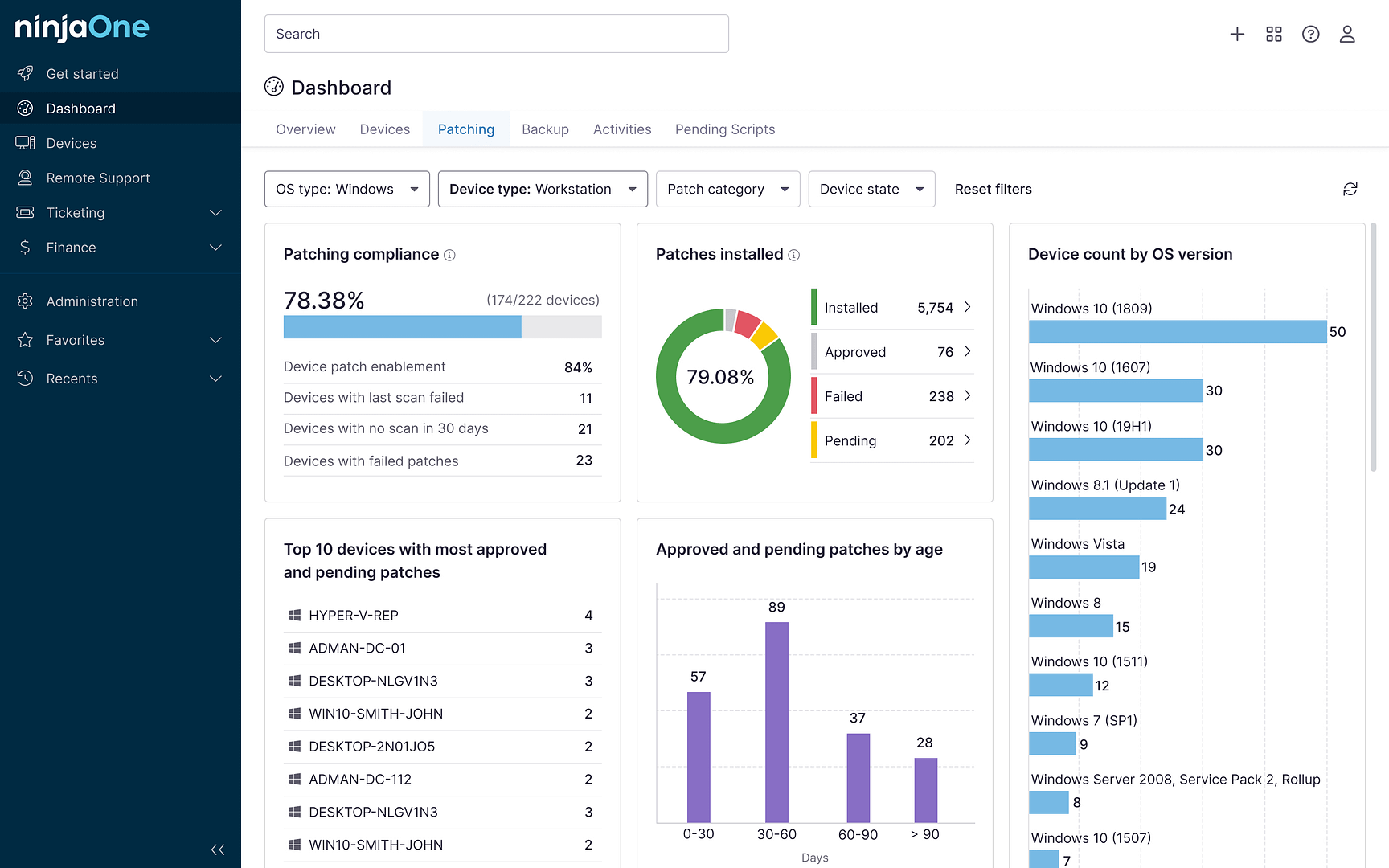

- Patch compliance: This refers to how well devices in your network are successfully patched.

- Environmental compliance: This refers to how businesses meet sustainability and environmental protection regulations.

It’s worth mentioning that some of these may overlap, especially if you work in a highly regulated industry.

Common regulatory standards

Some common regulatory standards included in a compliance management strategy are:

- ISO 37301: Guidelines for compliance management systems. Read more about ISO compliance here or check out this guide on how to become ISO certified.

- SOC 2: Focuses on data security for service providers.

- PCI DSS: Ensures secure credit card transactions. Read more about PCI compliance here.

- GDPR: Protects consumer data privacy in the EU.

- HIPAA: Governs healthcare data security.

- DORA: Describes cyber-resilience among EU financial institutions.

- CMMC: Safeguards sensitive information shared by the Department of Defense.

NIS2: Strengthens cybersecurity among EU organizations. Read this guide on the requirements for NIS2 compliance or this article on NIS2 vs ISO 27001 for more information.

Learn how to build cyber resilience for NIS2 readiness.

→ Download this free NinjaOne guide.

Why is compliance management important?

Compliance management plays a critical role in maintaining your organization’s integrity. It helps foster better customer trust, save costs and time, automate compliance processes, and reduce risks associated with non-compliance. For example, patch compliance enables IT teams to secure their IT environment and protect their devices and end users.

Moreover, compliance management ensures that a company’s activities adhere to all regulations and laws, thereby mitigating legal issues and enhancing the organization’s reputation.

We must emphasize the proactive nature of compliance management. While it may seem like a “nice-to-have” strategy to avoid hefty penalties, it’s more about building a culture of responsibility and accountability. With the right compliance management strategy in place, you ensure your organization can protect its data integrity and improve operational efficiency.

In summary, compliance management is important because it can lead to:

- Stronger legal and financial protection: Noncompliance can result in fines, lawsuits, and even reputational damage. For example, GDPR fines can be up to €20 million or 4% of your firm’s worldwide annual revenue from the previous financial year, whichever is higher.

- Enhanced cybersecurity: Compliance frameworks like SOC 2 and NIS2 help organizations implement strong security controls to protect sensitive data from being exploited by various threat actors.

Improved operational efficiency: Effective compliance management can streamline workflows, reduce human errors, and enhance organizational transparency. It’s a good idea to automate some of these processes in an automated compliance management system (CMS) or something similar. We talk more about IT automation here.

How to manage compliance

Managing compliance in a business setting requires a structured and systematic approach. It begins with thoroughly understanding the laws, regulations, and standards applicable to your industry and business operations. Then, you need to establish clear policies and procedures that align with these regulations. Training your employees on these policies is crucial to ensure they understand their responsibilities.

Regular audits and assessments should be conducted to monitor adherence to these guidelines. Any non-compliance identified should be addressed promptly to mitigate risks. Leveraging technology can also be beneficial, as compliance management software can automate and streamline many of these processes, making it easier to maintain compliance and keep up with any regulation changes.

We recommend following these four steps to successfully monitor compliance in your business.

⚠️Take note that these steps can be adjusted as needed to suit your specific industry.

- Assess your business infrastructure: Identify any non-compliant or vulnerable systems.

- Organize your compliance management efforts: Prioritize compliance actions by issue severity and, if necessary, their alignment with your IT budget.

- Remediate vulnerabilities: Patch and reconfigure systems.

- Report actions: Monitor and validate that changes were applied.

Compliance management challenges

Despite its importance, compliance management is not without its challenges. Keeping up with ever-changing laws and regulations can be daunting. Lack of proper communication and training, coupled with inadequate resources, can also hamper effective compliance management.

In addition, detecting and troubleshooting any non-compliance can be difficult. Without proper processes in place, things can slip through the cracks unnoticed. To successfully manage compliance, organizations need to ensure they have the right systems and tools.

Complexity of regulations

The regulatory environment is continually evolving, with laws varying across industries and regions and even new laws being implemented each year. This can be incredibly confusing for Chief Compliance Officers, especially for those who manage globally distributed teams.

Human error

Human error remains a significant factor in compliance failures. In 2024, 66% of Chief Information Security Officers (CISOs) in the United States stated that human error was their most significant cyber vulnerability (Statista). This highlights the need for regular and effective cybersecurity education programs to reduce mistakes that can lead to non-compliance.

High costs

The cost of non-compliance is both actual and figurative. There is the physical monetary cost, which we’ve seen can reach millions of dollars. But there is also the reputational cost. If your company is seen as non-compliant with regulations, it will have a harder time maintaining customers or getting new ones.

Education and information constraints

Many organizations face resource constraints that may hinder effective compliance management. However, recent data from Gartner suggests positive movement in this area. According to their research, 67% of Chief Compliance Officer are prioritizing the quality of the information used for compliance risk detection and 76% are prioritizing improving their approach to managing third-party risks.

Technological advancements

The European Union recently provisionally approved the AI Act in December 2023, which offered guidelines for the design, production, and implementation of AI systems by 2026. While compliance will vary according to industry and company size, organizations must take special care to meet these new standards, adding complexity to compliance efforts.

You can read up-to-date developments on the official website.

Compliance management best practices

Despite these challenges, businesses can adopt several best practices to enhance their compliance management. These include implementing a robust compliance program, fostering a culture of compliance within the organization, conducting regular audits and assessments, and leveraging technology to automate and streamline compliance processes.

- Stay updated on regulatory changes: Consider subscribing to industry newsletters or participating in professional associations to stay updated on regulatory changes.

- Conduct regular risk assessments: Regular risk assessments help pinpoint existing vulnerabilities, assess the likelihood and impact of non-compliance, and implement the appropriate mitigation strategies.

- Implement comprehensive policies and procedures: Clear, well-documented policies and procedures provide a foundation for compliance efforts. It’s wise to regularly review and update these documents to ensure they remain relevant when addressing current compliance requirements.

- Leverage technology for compliance automation: Automation tools can help track regulatory changes, manage documentation, and generate reports.

- Foster a culture of compliance and ethics: Build an organizational culture that prioritizes compliance and ethical behavior among employees.

- Integrate compliance with risk compliance: Align your compliance efforts with your organization’s overall risk management strategy. This ensures a cohesive approach to identifying and mitigating risks.

- Monitor third-party compliance: Establish a process to assess and monitor third-party compliance. This proactively protects your organization from potential liabilities.

Future of compliance management

Here are four key areas shaping the future of compliance management:

- AI-driven compliance management: Artificial intelligence and machine learning are revolutionizing compliance management by automating risk assessments and detecting anomalies. AI-driven solutions can analyze vast amounts of data in real time, providing proactive alerts on potential compliance violations.

- Expansion of data privacy regulations: Laws like GDPR, CCPA, and China’s Personal Information Protection Law (PIPL) are setting stricter requirements for data collection, storage, and sharing.

- Increased scrutiny on ESG compliance: Environmental, Social, and Governance (ESG) compliance is becoming a priority for regulators and investors. Companies are facing increased expectations to report their sustainability efforts and ethical labor practices.

- Development of regulatory technology (RegTech): RegTech uses advanced technologies like big data, AI, and predictive analytics to simplify complex regulatory processes. We recommend reading this Deloitte article to learn more.

Prioritize compliance management

In conclusion, as we continue to grapple with an increasingly regulated business environment, compliance management will undoubtedly remain a top priority for organizations. By understanding its significance and employing best practices, businesses can not only ensure regulatory compliance but also foster a culture of corporate responsibility and accountability.